life insurance policy types

Thus before selecting to buy a life insurance plan it is necessary to know the. Convenience short term can provide temporary coverage.

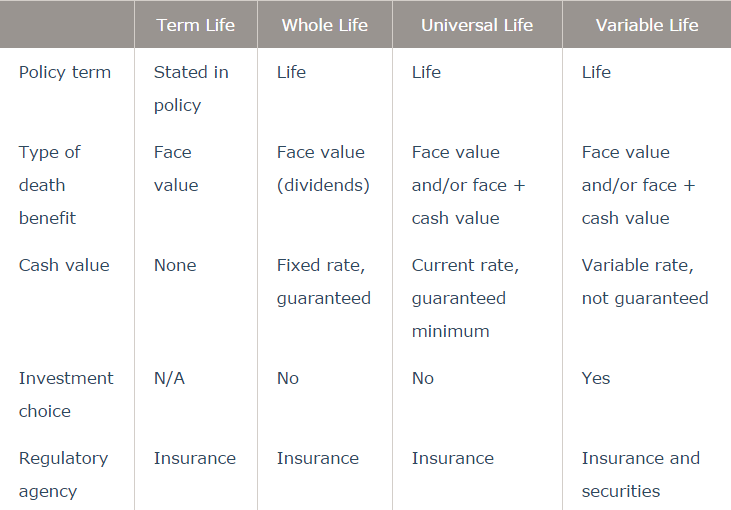

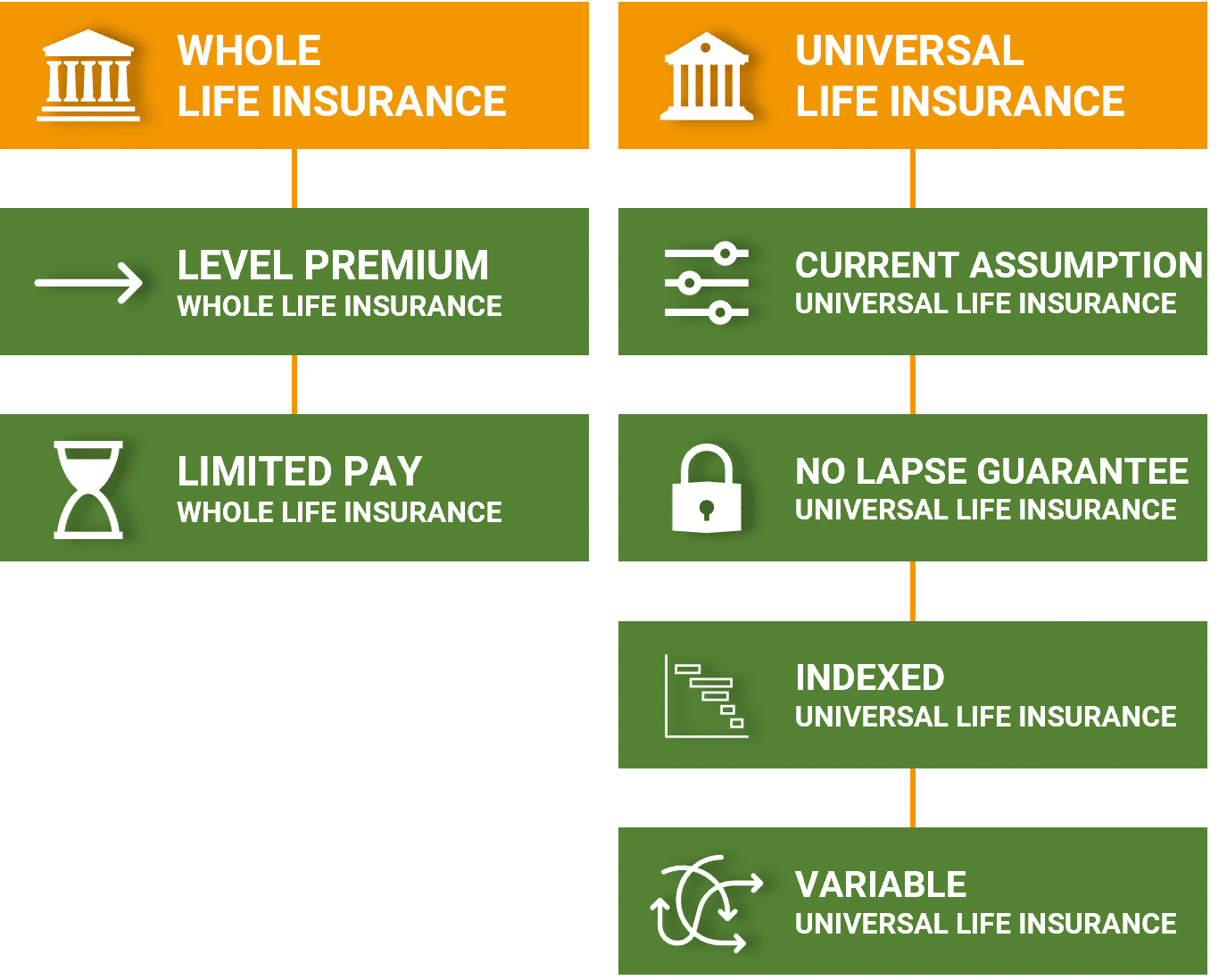

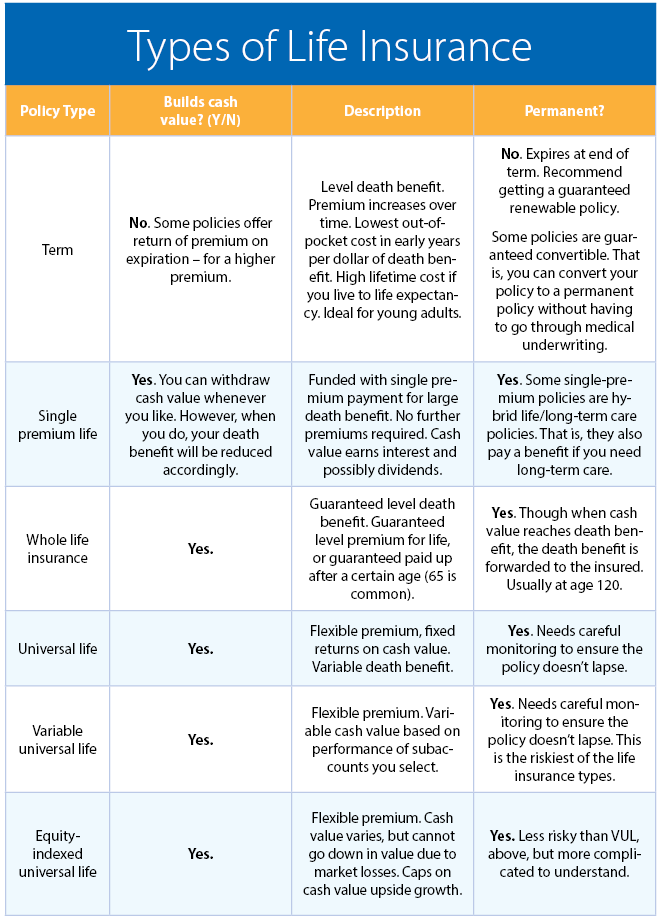

What Are The Different Types Of Permanent Life Insurance Policies Iii

B Family income policy.

. Term life insurance is typically sold in lengths of one five 10 15 20 25 or 30 years. Long-term saving option for people with much lower risk appetite for investment. Term life insurance is best if you are.

The length of time it takes for a life insurance policy to pay out depends on a number of factors including the type of policy and the age of the beneficiary. With this policy the insured person pays a fixed premium. C Survivorship life policy.

Benefit of Endowment Plan. But there are significant differences among life insurance policies. Term Life Insurance.

A Joint life policy. There are many types of life insurance policies that can help protect your family and they all fall into two main categories. The coverage typically lasts anywhere from 10 to 30 years but can.

Unbundled Life Insurance Policy. If youre concerned about taxes shrinking the assets. Provides full risk cover against any type of eventuality.

Term life insurance is the simplest and usually the most affordable type of life insurance you can buy. Types of life insurance for high-net-worth applicants. Younger on a budget and dont need coverage for more than 15 years.

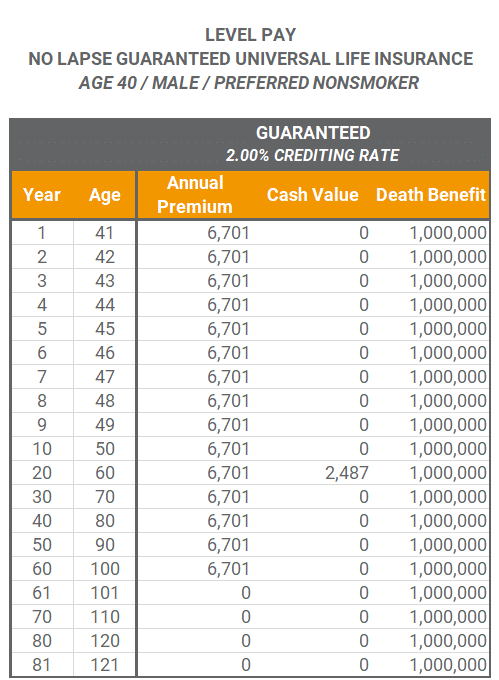

Premiums remain the same for a specific amount of time for. How it works. How to Choose Permanent Life Insurance.

The two most common policy types include annual renewable life insurance and temporary life insurance. 702 j Retirement Plan Definition. Thats because its insurance that does one.

D Modified endowment contract. Offers life insurance coverage till 100 years of age. Term life insurance policies lock in level premiums for a set period such.

Premiums start low but grow larger every year. A Joint life policy. Two main types to consider include whole life insurance which covers you for however long you live.

Here is how the death benefit works with term life vs. But inside life insurance you have several policy options with fulfilling a different financial goal. The type of insurance you choose depends on your financial goals.

Group life insurance. This is the most common type of life insurance and it pays out a monthly benefit for as long as you are alive. Coverage amounts vary depending on the policy but can go into the millions.

The type of life policy he is looking for is called a. This type of life insurance policy covers an insured person for hisher whole life. With a term life policy you get.

Learn more about term life insurance. These types of policies are classified as decreasing term policies. 2 days agoThe type of life insurance Ramsey warns against is mortgage life and credit life insurance.

Long-term financial planning and an opportunity to earn returns on. Three types of term life insurance include.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Types Of Life Insurance Term Insurance Whole Life Insurance Endowment Policy Ulip S Pension Plans

About Wfl Insurance Sarasota Insurance Services

9 Types Of Life Insurance Forbes Advisor

5 Types Of Life Insurance Policygenius

The 8 Major Types Of Life Insurance Policies Jrc Insurance Group

Types Of Life Insurance Explained Youtube

What Are The Different Types Of Life Insurance Policies

9 Best Life Insurance Companies Of October 2022 Money

Kaminsky Associates There Are Many Types Of Life Insurance Policies That Can Help Protect Your Family And They All Fall Into Two Main Categories Term And Permanent Check Out Our

![]()

How To Pick The Right Life Insurance How Much You Need

The 7 Types Of Life Insurance Policies What S The Best One For You

Basics Of Life Insurance Terms

What Are The Different Types Of Life Insurance Policies

Understanding Life Insurance What Policy Type Is Best For You

Types Of Life Insurance Nerdwallet

Whole Types Of Life Insurance Policies Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas